does betterment provide tax documents

Youll Be Able To Download Your Tax Forms There are many tax considerations when investingyou may need to keep track of dividends cost basis realized capital gains and. For more information please see the TurboTax FAQ below.

Betterment Sophisticated Online Financial Advice And Investment Management Investing Saving App Investment Tools

Betterment has multiple pricing plans from fee-free plans to 04 annual fees.

. Betterment also offers tax-loss. 1 Once in your return click Income Expenses top tabs 2 Scroll down. The no-fee plan costs 0 in fees and requires 0 in a minimum balance.

With Betterment you can automatically import your tax information into TurboTax. Yes Betterment is a TurboTax Import Partner so you may import your tax information into TurboTax. The company earns money by charging clients an annual management fee which is a percentage of the total value of the portfolio.

Betterment provides automatic tax loss harvesting to all investors at no extra cost for Taxable accounts only. When importing tax forms you will be able to deselect certain tax. Simplified set-up and administration makes it easy to offer your employees a better 401k.

The four methods stated. Note that we do not currently support integration with. If you are not able to import your transactions into TurboTax you can enter them manually.

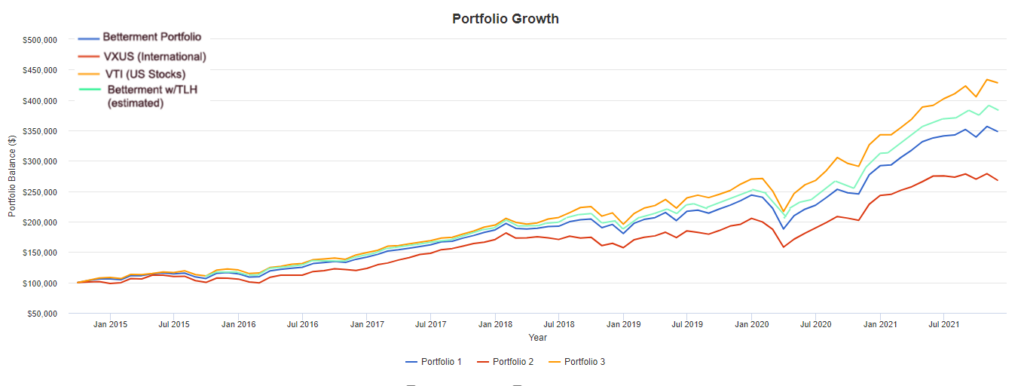

Betterment tax forms do not include a FATCA box as we do not allow for foreign investments in Betterment accounts. According to Betterment tax-loss harvesting and tax-coordinated portfolio strategies combined can boost investor returns by as much as 266 annually. Every tax year Betterment will generate and make available to you the required 1099-B and 1099-DIV tax forms for the TIN or SSN of the trust.

But it doesnt have direct-indexing like. At the end of the year you will get a tax. Any dividends earned will be taxable.

Ad Offer your employees a better 401k for a fraction of the cost of most providers. Betterment is definitely not a scam. A betterment is a specific type of project performed by a government entity that improves a specific area.

Somewhat pricey financial advisor consultations. Betterment offers tax-loss harvesting on taxable accounts. This is the only one that matters for tax purposes.

Does Betterment Send Tax Forms 2022. Betterment does provide Form 5498 to its members as long as they have made the IRA contributions made conversions as well as rollovers in their. Ad Offer your employees a better 401k for a fraction of the cost of most providers.

Betterments 2021 SEP contribution deadline. Simplified set-up and administration makes it easy to offer your employees a better 401k. 30 2020 Updated Dec.

Edit your portfolio strategy. A Betterment account opened late January 2021 so first time filing taxes on it the desktop version of HR Block 2021 Deluxe Efile State. Betterments tax strategy is just fine but rival Wealthfront is among the robo-advisors with a more sophisticated tax strategy.

Last day to donate shares to. 17 2022 1159 PM ET. The platform automatically reviews your investments daily to reduce tax exposure.

Every tax year Betterment will generate and make available to you the required 1099-B and 1099-DIV tax forms for the TIN or SSN of the trust. For example if your account has about 5000 in it the Betterment fees will be only 1 monthly at a 035 annual price. If you have a personal and trust account.

View tax forms statements and other documents. If you have a personal. Any tax forms from Betterment that do not have a FATCA box can be.

31 is the deadline for Betterment to provide Form 1099-R which reports distributions conversions and rollovers. Any sales where you make money will be a taxable event. There are three general tiers of costs but the costs change.

So clearly rounding amounts from a. This account includes a. They are not intended to provide comprehensive tax advice or.

You will not receive a 1099-R for a direct trustee-to-trustee transfer from. Does betterment provide tax documents Saturday March 12 2022 Edit. Betterments 2021 IRA contribution deadline.

The soonest you can start importing is Feb. Betterment does offer tax-loss harvesting automatically. Tax loss harvesting TLH works by using investment losses to.

Betterment LLCs internet-based advisory services are designed to assist clients in achieving discrete financial goals. While many believe that the Betterment tax program utilizes tax deferral the program instead offers numerous methods for lowering the tax bills of investors.

Tax Smart Investing With Betterment

Betterment Review Automated Financial Investment Robo Advisor Investing Financial Investments Portfolio Management

This Calendar Breaks Down Everything You Need To Do For Your Taxes In 2015 Season Calendar Tax Season Tax

A Beginner Investors Guide To Vanguard And Betterment Two Quality Low Cost Investment Providers So You Can Deter Finance Investing Investing Investing Money

Betterment Mobile App Investing On The Go

The Betterment Experiment Results Mr Money Mustache

6 Tax Strategies That Will Have You Planning Ahead

Betterment Review Smartasset Com Cash Management Retirement Retirement Accounts

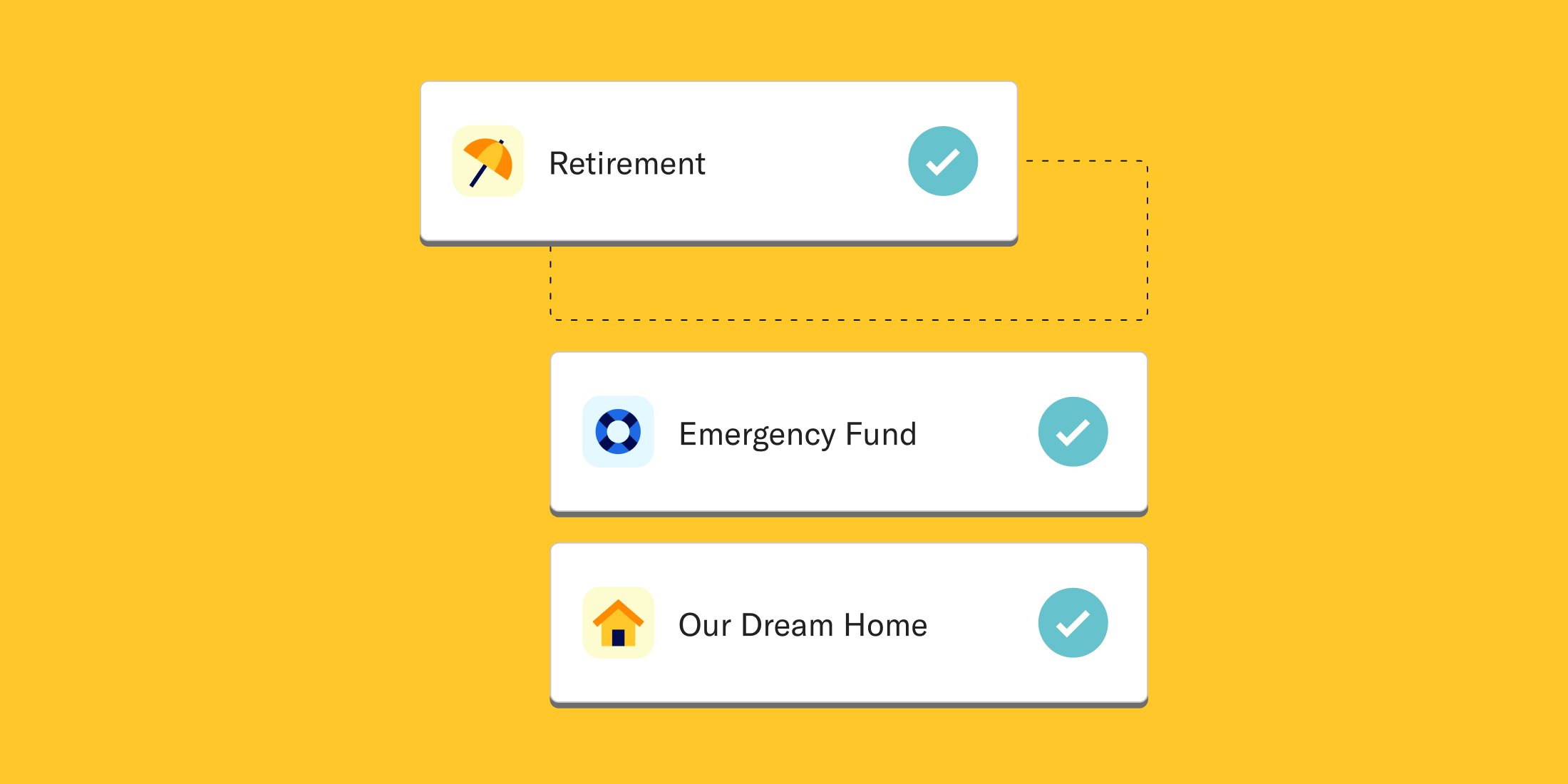

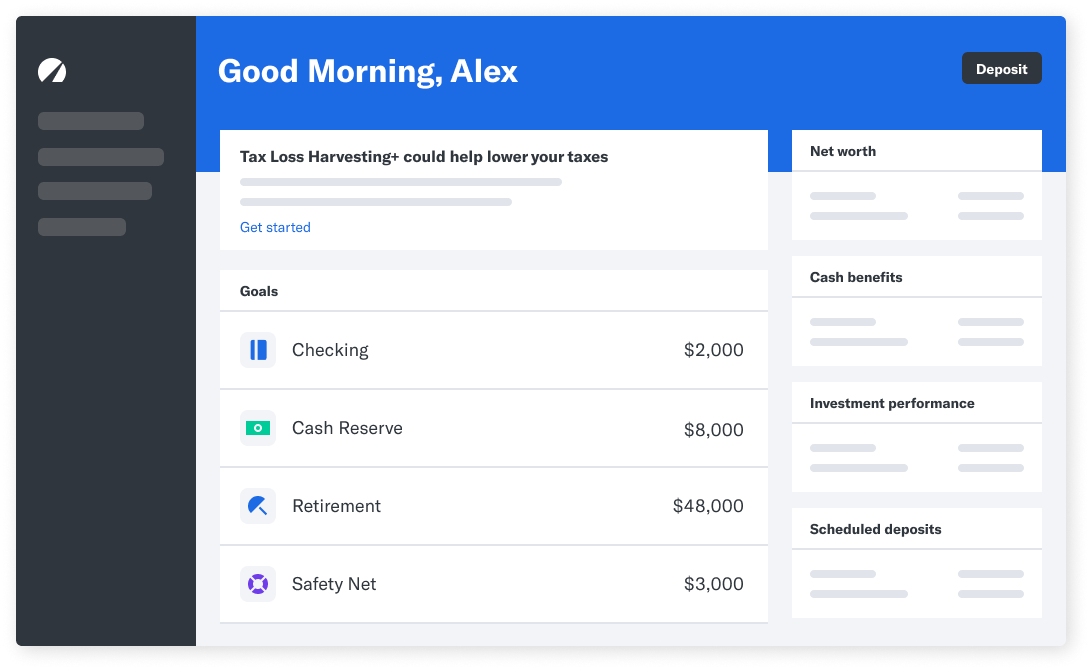

Using Investment Goals At Betterment

/wealthsimple-vs-betterment-1c84228732c642fe91a5844e25b18589.jpg)

Wealthsimple Vs Betterment Which Is Best For You

How To Open An Account With Betterment

Retirement Advice Retirement Calculator Investing For Retirement

Betterment Roi Sucks Feb 2018 To Mar 2021 R Financialindependence

Tax Smart Investing With Betterment

Betterment 2022 Review Is It Still The Best The Ascent By Motley Fool

Why Has Betterment Frozen Checking Account Applications Forbes Advisor

Betterment Taxes Explained 2022 How Are Investment Taxes Handled